Do you own or work in a high cash business like a restaurant? Gas station? Retail shop? These sort of businesses involve several safety risks as employees are asked to handle large amounts of cash on a daily basis. A good manager of a high-cash business takes this threat seriously and puts into play proper protocol to keep risk at a minimum. The following cash handling self-assessment questionnaire is designed to assess the protocol employed at cash handling location and to help establish and monitor good cash handling systems. Remember that this is only an informational questionnaire and if you have further questions about cash handling procedures, you should contact your local police department or a company that specializes in these procedures. Provide a brief statement in the comments section for all the items you have marked “NO”. For the items you have marked “YES” or “N/A” you may provide a comment or information that will assist in identifying improvement areas.

| YES | NO | N/A | COMMENTS | |

| Physical Safekeeping of Cash and Checks | ||||

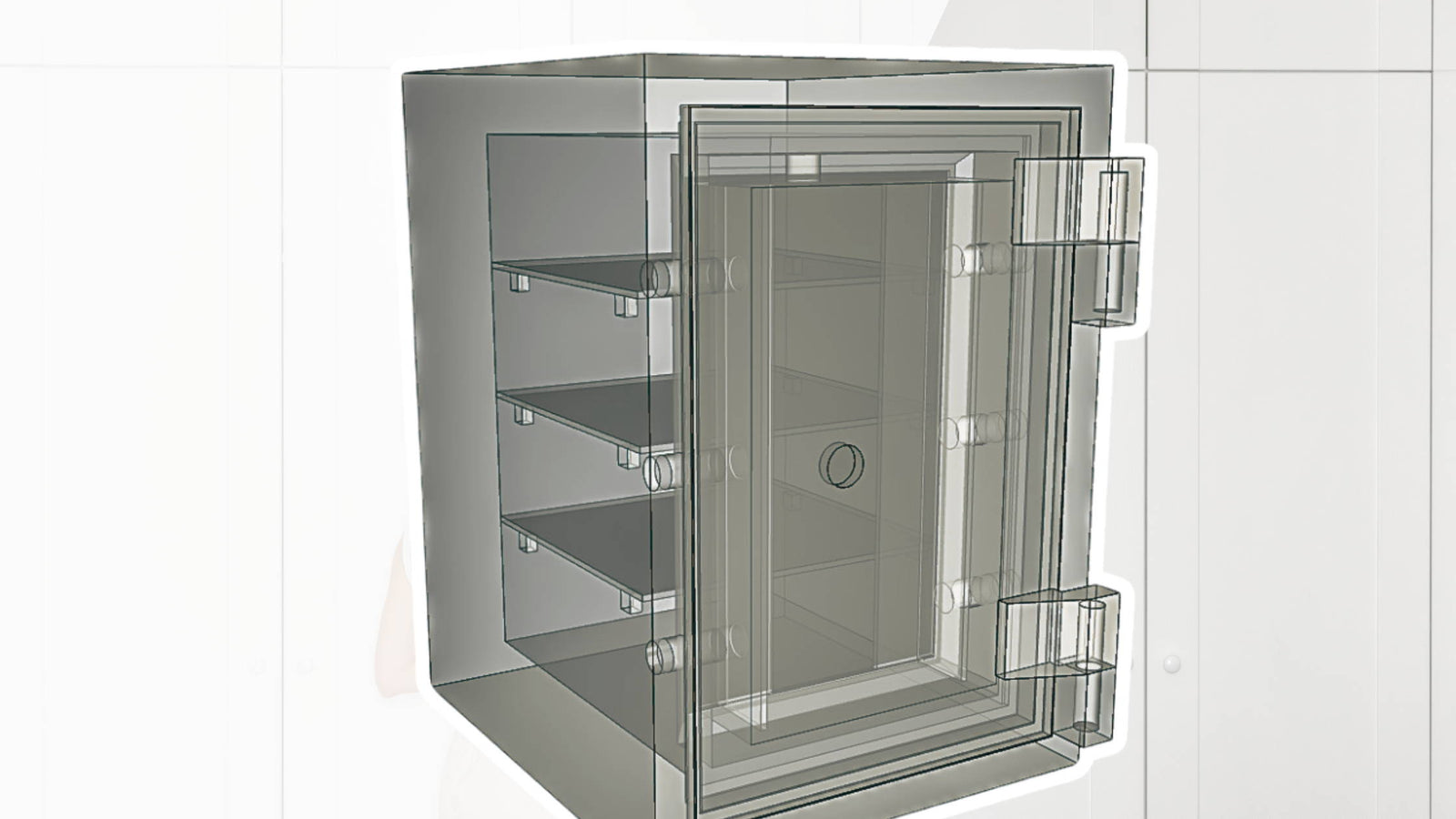

| 1. Is an adequate physical facility provided for safeguarding cash? | ||||

| 2. If secure areas are provided, such as safe or locked boxes, are the safe combinations and keys restricted to a minimum number of employees? | ||||

| 3. Are lists maintained by senior individuals identifying who knows safe combinations and has keys to locked boxes and areas? If yes, are the lists maintained in a secure/locked area? | ||||

| 4. Are safes and locked areas locked at all times when unattended? | ||||

| 5. Are safe combinations and keys changed at the transfer or termination of key employees or based on other security reasons. If yes, provide list of names and dates of last changed? | ||||

| 6. Are the keys to cashier areas stamped with ‘Do Not Duplicate’? | ||||

| 7. Are only authorized individuals allowed in the cash handling areas? | ||||

| 8. Does the cashier have access to a security alarm or buzzer that would alert management or security personnel of robberies or other threatening activities? | ||||

| 9. Has the local Police Department or professional security experts evaluated your premises and your procedures? If YES, describe changes you have made based on the evaluations. | ||||

| 10. Has fraud, robbery or other type of incidents occurred in the cash handling area? If Yes, describe the incident and provide the date and dollar amount of loss. | ||||

| 11. Have all the cashiers completed some form of cash handling training? | ||||

| Segregation of Duties | ||||

| 12. Are all bank statements, deposit slips etc. sent to someone other than the person making the deposit? If Yes who receives them? | ||||

| 13. Are the bank statements reconciled on a monthly basis? Who reconciles the bank statement? | ||||

| 14. Are the individuals responsible for the cash receipt function prohibited from signing checks or reconciling the bank statement? | ||||

| 15. Is mail opened by a person who does not prepare bank deposits and does not have access to accounts receivable? | ||||

| 16. Are employees who collect and deposit cash prevented from recording cash receipts and preparing general ledger entries? | ||||

| Cash Receipting | ||||

| 17. Are all receipts controlled by cash register, pre-numbered receipt slip or invoice or other equivalent means? Describe the cash receipting controls you use? | ||||

| 18. Do all the cash registers work properly and are they capable of generating cash register receipts and other summary reports? | ||||

| 19. Do cashiers record all transactions in the cash register immediately upon receiving money? | ||||

| 20. Do the cashiers provide cash register receipts to all customers? | ||||

| 21. Are signs placed at the cashiers’ area advising the public that a receipt is required? | ||||

| 22. Is only one cashier individually responsible for each cash drawer at any given time? | ||||

| 23. Are employees required to get supervisor’s approval before voiding transactions? | ||||

| 24. Is the cashing of personal checks made payable to the Company prohibited? | ||||

| 25. Are checks restrictively endorsed ‘Company Name, For Deposit Only’ immediately upon receipt? | ||||

| 26. Does the cash register summary tape summarize the number of voids, no sales, refunds and other miscellaneous transactions? | ||||

| 27. Are cash receipt reconciled with the cash register summary report tapes on a daily basis? | ||||

| 28. Are the cash register summary report tapes numbered sequentially, dated and time stamped? | ||||

| 29. Are cash receipts refunds made by check/warrant to the individual making the deposit? | ||||

| 30. Do you accept credit cards at the cash handling site? | ||||

| Cash Depositing: | ||||

| 31. Are receipts recorded promptly and deposited intact within (suggest no longer than 48 hours)? | ||||

| 32. Do you prepare deposit slips indicating the funds deposited? If yes, is the person preparing the deposit different from the one who initially received the funds? | ||||

| 33. Do deposit slips show the amount of each check deposited? | ||||

| 34. Is the make-up of the deposit (amounts of coin, cash denomination or check) clearly documented? | ||||

| 35. Are duplicate deposit slips prepared (one sent to the bank and one retained by the organization)? | ||||

| 36. Do you use tamper-proof deposit bags for deposit? | ||||

| 37. Does a person other than the cashier verify the deposit against the cash receipt? | ||||

| Monitoring: | ||||

| 38. Are receipts accounted for and balanced to receipt records (register tapes, receipt books etc.) on a daily basis? If yes, is the person different from the one who initially received the funds? | ||||

| 39. Does management verify the cash and check amount on the deposit slips to the summary register tapes? | ||||

| 40. Are all overages and shortages reported to management? | ||||

| 41. Are unusual variations in revenue investigated by management? | ||||

| 42. Does management investigate all substantial variations from norms such as cash register voids, no sales, refunds, errors etc.? | ||||

| 43. Are all original voided or canceled receipts retained and accounted for in the records? | ||||

| 44. Are all pre-numbered documents that are voided accounted for? | ||||

| 45. Are cash funds periodically counted on a surprise basis by an independent employee? If Yes, who performs the cash count? Please provide the two most recent dates of the cash counts? | ||||

| 46. Does the cash handling area have written Departmental cash handling policies and procedures? | ||||

| 47. Do you perform criminal checks on new employees? | ||||

| 48. Are criminal checks made periodically after hire? | ||||

| 49. Are all cashiers required to take annual vacations, and the responsibilities handled by someone else during their absence? |