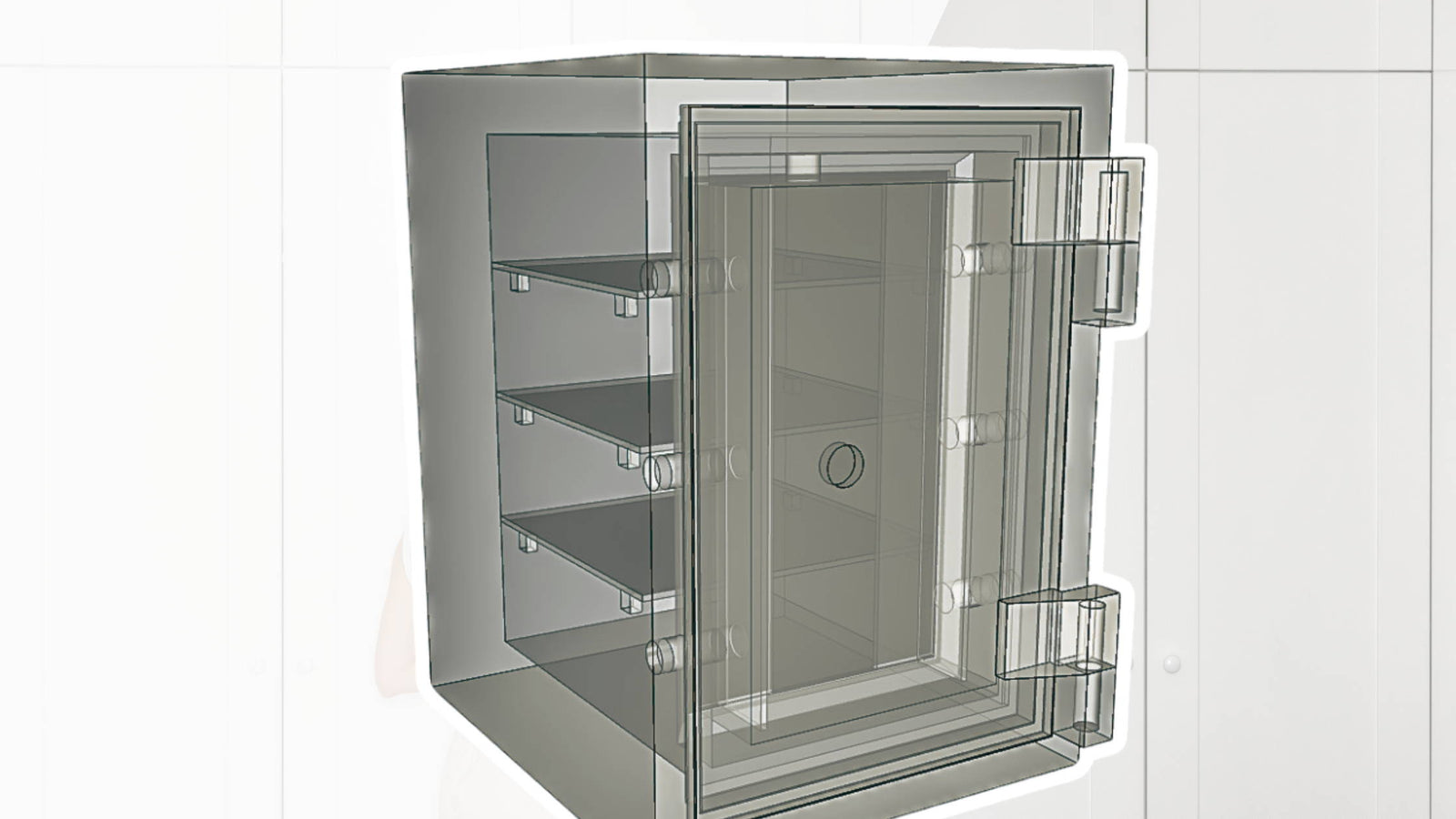

Let us not forget that safes and vaults are for more than personal use, storing home documents, birth certificates, and other valuables. Many of the world’s safes are located in banks (often called safety deposit boxes) and are home to all sorts of valuables from across the globe. Today news has hit that nervous investors are flocking to Switzerland to lock their valuables up in Switzerland’s world famous safes.

With the Euro zone debt crisis and the ongoing recession in the United States, investors are feeling uncertain about where to put their wealth. Traditional investment vehicles may no longer be the answer they once were; there are also fears that with these crises at hand the policy governing investment and capital savings may be shifting and changing without much notice.

But even Switzerland may not be such a good place for your cash, gold, and other valuables now. "We are experiencing a rise in demand for safety deposit boxes. This rise can't really be quantified, however. In many branches the safe deposit boxes are fully rented," said Albert Steck, spokesman at Migros Bank, a cooperative bank which serves retail clients.

What do you think about this shift in investments and savings? Hopefully the global economy will be able to stabilize so that investors feel more comfortable going back to traditional investment vehicles like stocks and bonds. Until that time, maybe you should head over to Switzerland and get yourself a safety deposit box while you still can!

Have you been compelled to keep your investments closer to home? Are you forgoing traditional investment vehicles because the returns aren’t what they used to be? Are you looking at alternative places to put your money – like property? Art? Or gold? We’d love to know your opinion.